Table of Content

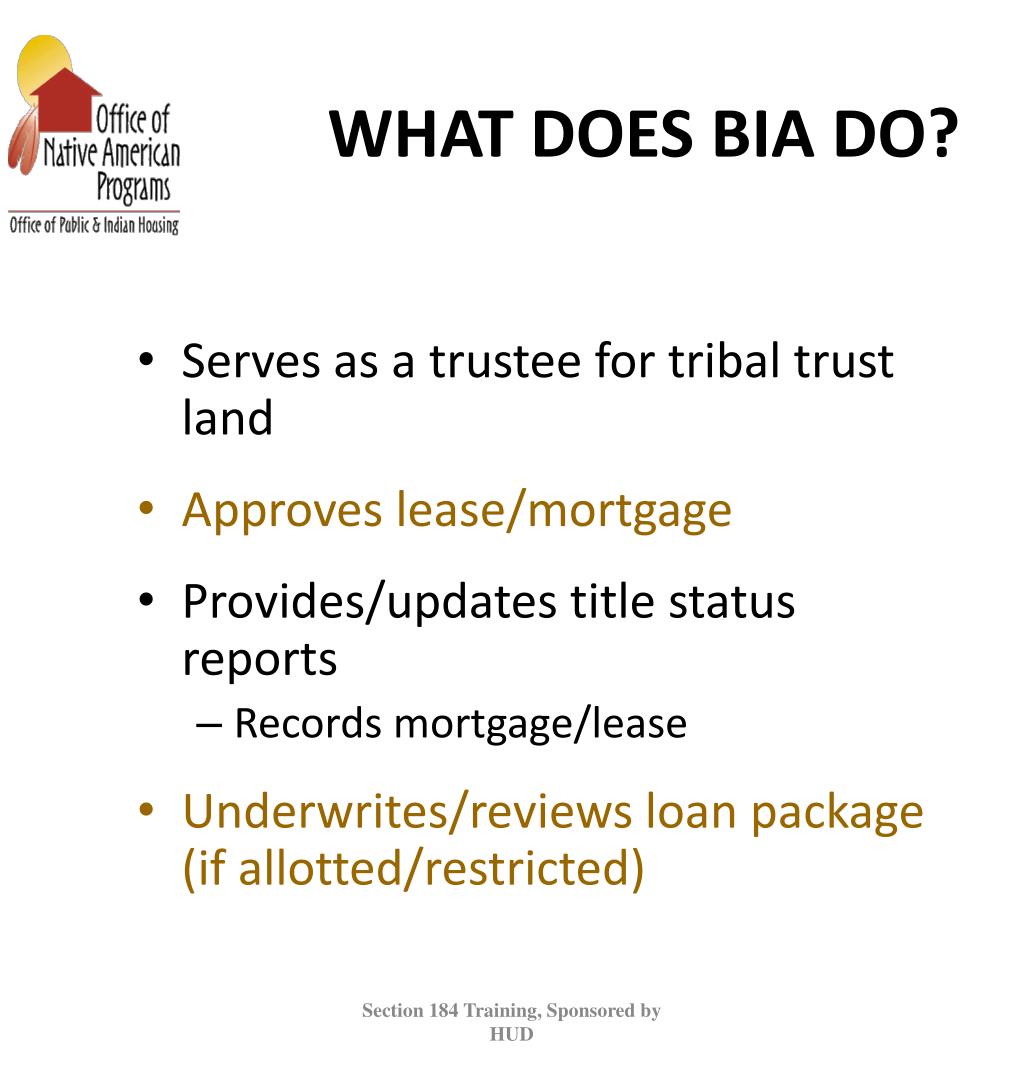

Borrowers must apply with a HUD-approved Section 184 lender. The program has grown to include eligible areas beyond tribal trust land. Click on the links below to determined participating States and counties across the country. The borrower applies for the Section 184 loan with a participating lender, and works with the tribe and Bureau of Indian Affairs if leasing tribal land. The lender then evaluates the necessary loan documentation and submits the loan for approval to HUD’s Office of Loan Guarantee. Our custom optimization engine and expert advisors will help you make the optimal decision for your personal circumstances.

Repayment period Regardless of the interest rate, the faster you repay your mortgage, the lower your financing costs will be, as you will only pay interest on the remaining loan amount. Vice versa, the slower you repay your loan, the higher your financing costs will be. How fast you repay your mortgage loan depends on the amount of your monthly rate and additional repayments you may make.

Loan Terms

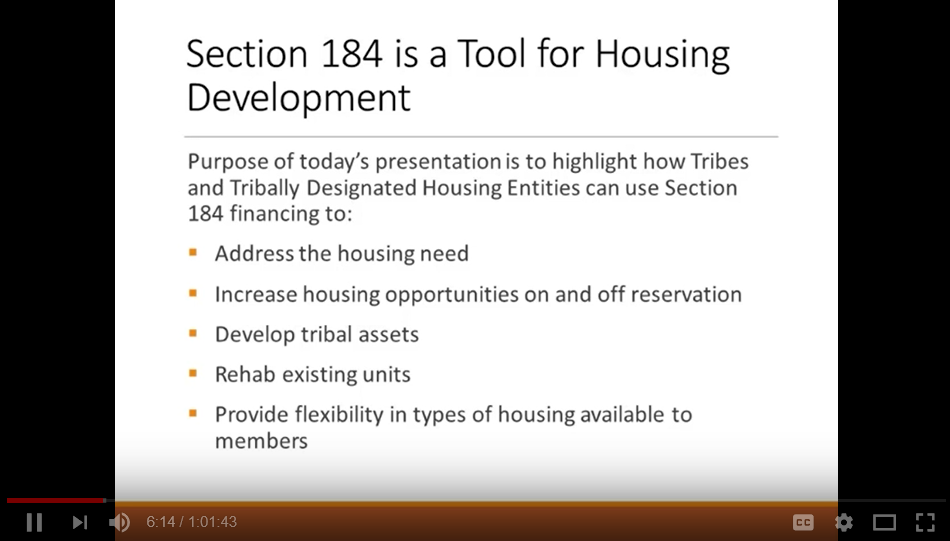

Refinance your existing home in Germany to lower interest rates or cash out on your home equity. Homeowners and renters can visit/housing for up-to-date information on their relief options, protections and key deadlines. Section 184 is synonymous with home ownership in Indian Country. As of March 2017, the Section 184 program has guaranteed over 37,000 loans (almost $6 billion dollars in guaranteed funds) to individuals, Tribes, and TDHEs.

The composition of interest and repayment changes slightly with each month. This is because each repayment reduces the remaining loan balance. Therefore, with a constant interest rate, and a declining remaining loan balance, the share of interest in the installments decreases month by month, while the share of repayment increases a little month by month.

What type of loan is HUD 184?

Section 184 loans can be used, both on and off native lands, for new construction, rehabilitation, purchase of an existing home, or refinance. The results of the mortgage calculator give you a first impression of your mortgage possibilities and help you to get orientated. It is a sample calculation that shows an overview of your expected costs. However, our calculator does not replace a personal consultation. Use the calculator to understand your mortgage repayment options. √ Extended the timeframe for homeowners to request the start of a COVID-19 Forbearance from their mortgage servicer through June 30.

Our team of experts will find you the optimal mortgage in Germany online.

HUD Proposes Rules to Strengthen Indian Home Loan Program

But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it. The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. √ Expanded the COVID-19 forbearance to allow up to two forbearance extensions of up to three months each for homeowners who requested a COVID-19 forbearance on or before June 30, 2020. To help increase Native access to financing, the Office of Loan Guarantee within HUD’s Office of Native American Programs, guarantees the Section 184 home mortgage loans made to Native Borrowers.

This German mortgage calculator is designed to help you determine the estimated amount you can get from over 750 mortgage lenders in Germany. However, German banks have different guidelines when it comes to rating the creditworthiness of applicants for a mortgage. For us to find the best mortgage for you, we need more information about you, your financial situation, and your future plans. With this information, our financing experts can explain your possible options in detail and provide a free personalized mortgage recommendation.

Eligible Borrowers

We'll calculate your maximum property budget based on your income, savings, residency status and the criteria of our 750+ partner banks. Banks in Germany like safety and are interested in you paying back the mortgage. That is why banks in Germany are so strict about approving a mortgage. Under certain conditions, it is also possible to finance a property without equity.

The Section 184 Indian Home Loan Guarantee Program is a home mortgage product specifically designed for American Indian and Alaska Native families, Alaska villages, tribes, or tribally designated housing entities. Congress established this program in 1992 to facilitate homeownership and increase access to capital in Native American Communities. To provide urgent economic relief to homeowners impacted by COVID-19, the U.S.

Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions. We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot. To find you the optimal mortgage, we will use our unique Hypofriend Recommendation Engine. We will begin by asking you several key questions, which will help us determine which mortgage products could work best for you. You can use the simple rent or buy calculator to evaluate if buying make sense for you.

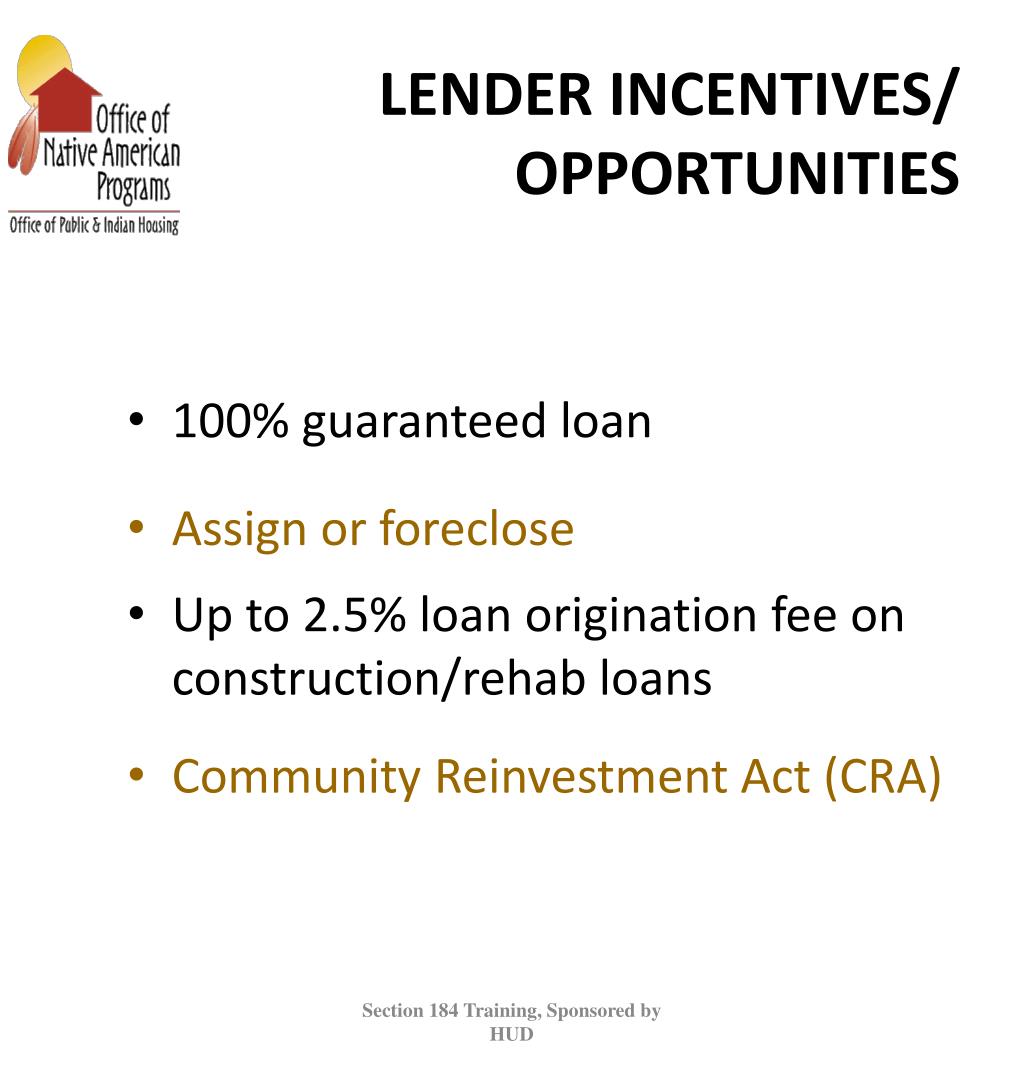

In Germany, most banks offer the option of additional repayments between 5% and a maximum of 10% per year. The German mortgage calculator provides, among other things, an overview of the additional purchase costs and monthly repayments resulting from the given mortgage and the duration of financing. HUD describes this program as, “a home mortgage product specifically designed for American Indian and Alaska Native families, Alaska villages, tribes, or tribally designated housing entities ” . With this financing opportunity, eligible borrowers can get into a home with a low down payment and flexible underwriting. These loans can be used on and off Native lands, for new construction, rehabilitation, purchase of an existing home, or refinancing.

Depending on the federal state, the property transfer tax is between 3.5% and 6.5% of the purchase price. To assist seniors with HECMs, FHA has extended the timeframe for the start of an initial COVID-19 HECM extension through June 30. For HECMs that entered an initial extension period on or before June 30, 2020, up to two additional three-month extension periods are available.

To find the right mortgage, there are some points you should consider. For example, it is advisable to plan the mortgage, so you have paid it off by the time you retire. Also, keep in mind that you usually need to pay the additional purchase costs yourself. However, it is possible to take out a separate personal loan for this purpose. Furthermore, your monthly repayment should be calculated realistically, so you can easily cover it without having to restrict your accustomed standard of living.

This extension provides homeowners with additional time to request a forbearance from their mortgage servicer. To get started, the borrower applies for the Section 184 loan with a participating lender and works with their tribe and, in some cases, the BIA. The lender will evaluate the necessary loan documents and submit the loan for approval through HUD’s Office of Loan Guarantee. The Navajo Nation is one of many tribes that participate in this program with maximum loan limits ranging between $331,250 to $979,968 .

These include, for example, a very good credit rating, a very high income, and an excellent location of the property. However, the bank will charge significantly higher interest. Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. Although many of the loan attributes and requirements are similar to FHA mortgages, it's important to note that a Section 184 loan is not an FHA loan.

No comments:

Post a Comment