Table of Content

- From mortgage calculator to your dream home

- Additional Information

- What is the lowest credit score you can have to buy a house?

- Can you refinance a HUD loan?

- HUD announces extensions & expansions of COVID-19 homeowner relief, home retention measures

- Program Description

- What is the difference between a HUD home and a foreclosure?

This will ensure you have enough money for your living expenses. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders. This is how we can understand exactly what offers are available and what conditions they have. We compare the best mortgage rates in Germany for the top 750 lenders. The Section 184 Indian Home Loan Guarantee Program is a home mortgage specifically designed for American Indian and Alaska Native families, Alaska Villages, Tribes, or Tribally Designated Housing Entities.

Forbearance is an option mortgage servicers use to provide homeowners with a pause to their monthly payments for a limited period of time during a COVID-19-induced hardship. After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate. Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan. However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call. With a short fixed interest rate period, on the other hand, you benefit from a lower interest rate.

From mortgage calculator to your dream home

But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it. The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. √ Expanded the COVID-19 forbearance to allow up to two forbearance extensions of up to three months each for homeowners who requested a COVID-19 forbearance on or before June 30, 2020. To help increase Native access to financing, the Office of Loan Guarantee within HUD’s Office of Native American Programs, guarantees the Section 184 home mortgage loans made to Native Borrowers.

Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions. We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot. To find you the optimal mortgage, we will use our unique Hypofriend Recommendation Engine. We will begin by asking you several key questions, which will help us determine which mortgage products could work best for you. You can use the simple rent or buy calculator to evaluate if buying make sense for you.

Additional Information

Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer. This depends on several factors, such as the amount of the mortgage and how much you want to pay back monthly. The rule of thumb is that the monthly mortgage payment should not exceed 40% of your net income.

Congress designed this program to facilitate homeownership and increase access to capital in Native American communities. HUD’s program is designed to facilitate homeownership and increase access to capital in Native American communities. Get the key facts on innovative products and services, investment vehicles, and government programs and initiatives related to community development and consumer banking. With Section 184 financing borrowers can get into a home with a low down payment and flexible underwriting.

What is the lowest credit score you can have to buy a house?

These loans come from HUD's Office of Native American Programs. Native Hawaiians can access homeownership loans through the Section 184A Program. Hypofriend GmbHis an independent mortgage broker certified with the §34i GewO supervised by BaFin. Hypofriend works together with over 750 partner banks to find customers the optimal mortgage.

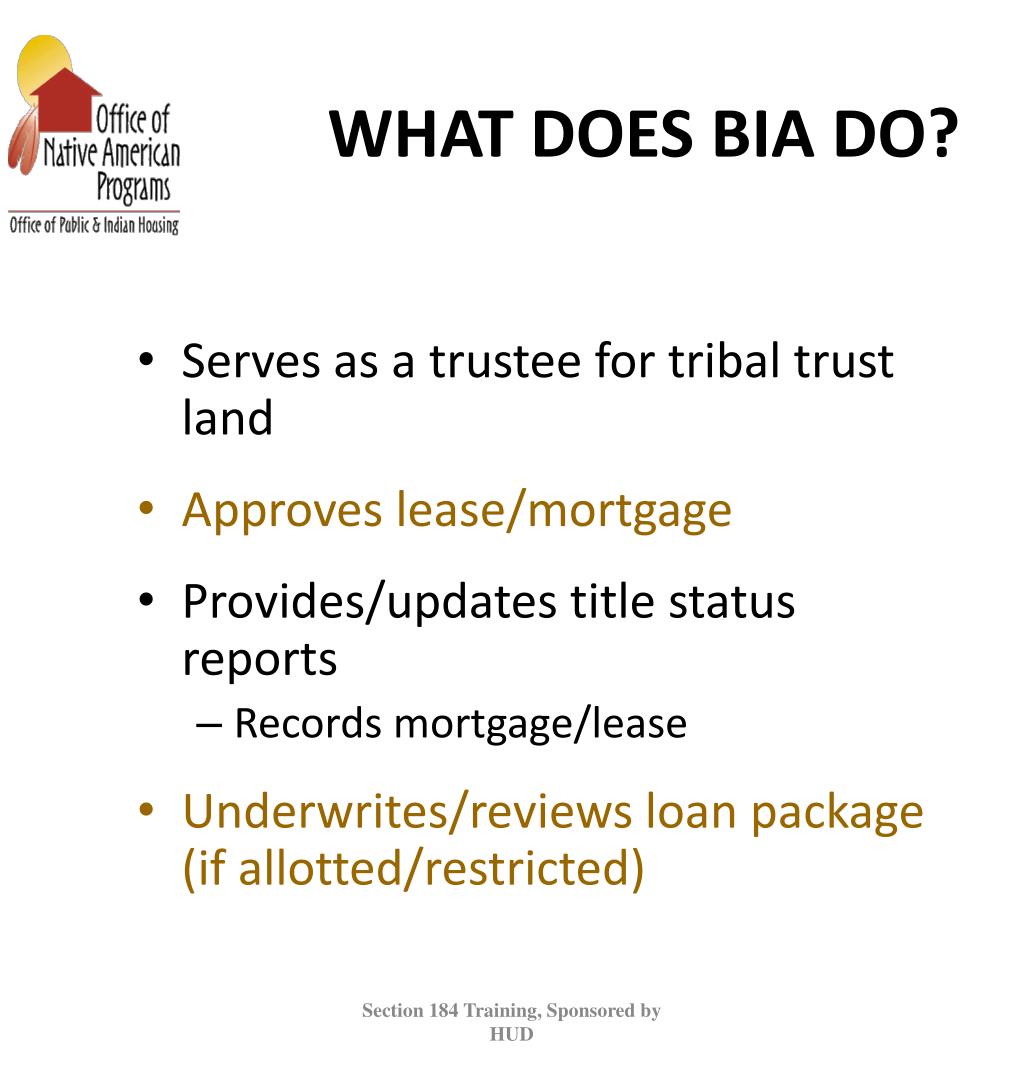

The Department of Housing and Urban Development wants to increase lender participation in its Section 184 program to meet increased borrower demand for housing financing on tribal trust lands. Indian Home Loan Guarantee Program offers home ownership to Native Americans through a mortgage loan program. In your secure online account, you can easily upload your required personal, property and mortgage documents to get approved faster than traditional brokers.

Can you refinance a HUD loan?

A press release stated, “HUD urges all homeowners who are able to make their mortgage payments to continue to do so. However, homeowners who need COVID-19 mortgage payment assistance should contact their mortgage servicer immediately or consider contacting aHUD-approved housing counseling agency. Homeowners may also visit HUD’scoronavirus relief for homeowners webpage or HUD’sCOVID-19 resources for Native Americanswebpage for additional information and resources. This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity. In other words, your savings component increases, month by month, year by year.

This extension provides homeowners with additional time to request a forbearance from their mortgage servicer. To get started, the borrower applies for the Section 184 loan with a participating lender and works with their tribe and, in some cases, the BIA. The lender will evaluate the necessary loan documents and submit the loan for approval through HUD’s Office of Loan Guarantee. The Navajo Nation is one of many tribes that participate in this program with maximum loan limits ranging between $331,250 to $979,968 .

The Section 184 Indian Home Loan Guarantee Program is a home mortgage product specifically designed for American Indian and Alaska Native families, Alaska villages, tribes, or tribally designated housing entities. Congress established this program in 1992 to facilitate homeownership and increase access to capital in Native American Communities. To provide urgent economic relief to homeowners impacted by COVID-19, the U.S.

The results of the German mortgage calculator are realistic sample calculations. However, they do not represent a financing proposal or a financing confirmation. For us to find the optimal mortgage for you, we need to know your personal financial situation. Our German mortgage calculator lists all additional purchase costs. A fixation period which is too short could cause you financial hardship if interest rates go up significantly in the future.

Depending on the federal state, the property transfer tax is between 3.5% and 6.5% of the purchase price. To assist seniors with HECMs, FHA has extended the timeframe for the start of an initial COVID-19 HECM extension through June 30. For HECMs that entered an initial extension period on or before June 30, 2020, up to two additional three-month extension periods are available.

No comments:

Post a Comment